Independent reviews are one of the most important parts of staying compliant with the Retail Payment Activities Act (RPAA). Every three years, payment service providers must arrange for an external check on key compliance frameworks. This is not just a formality. Done right, it helps strengthen controls, reassure customers, and reduce the chance of regulatory issues.

Which frameworks must undergo independent review

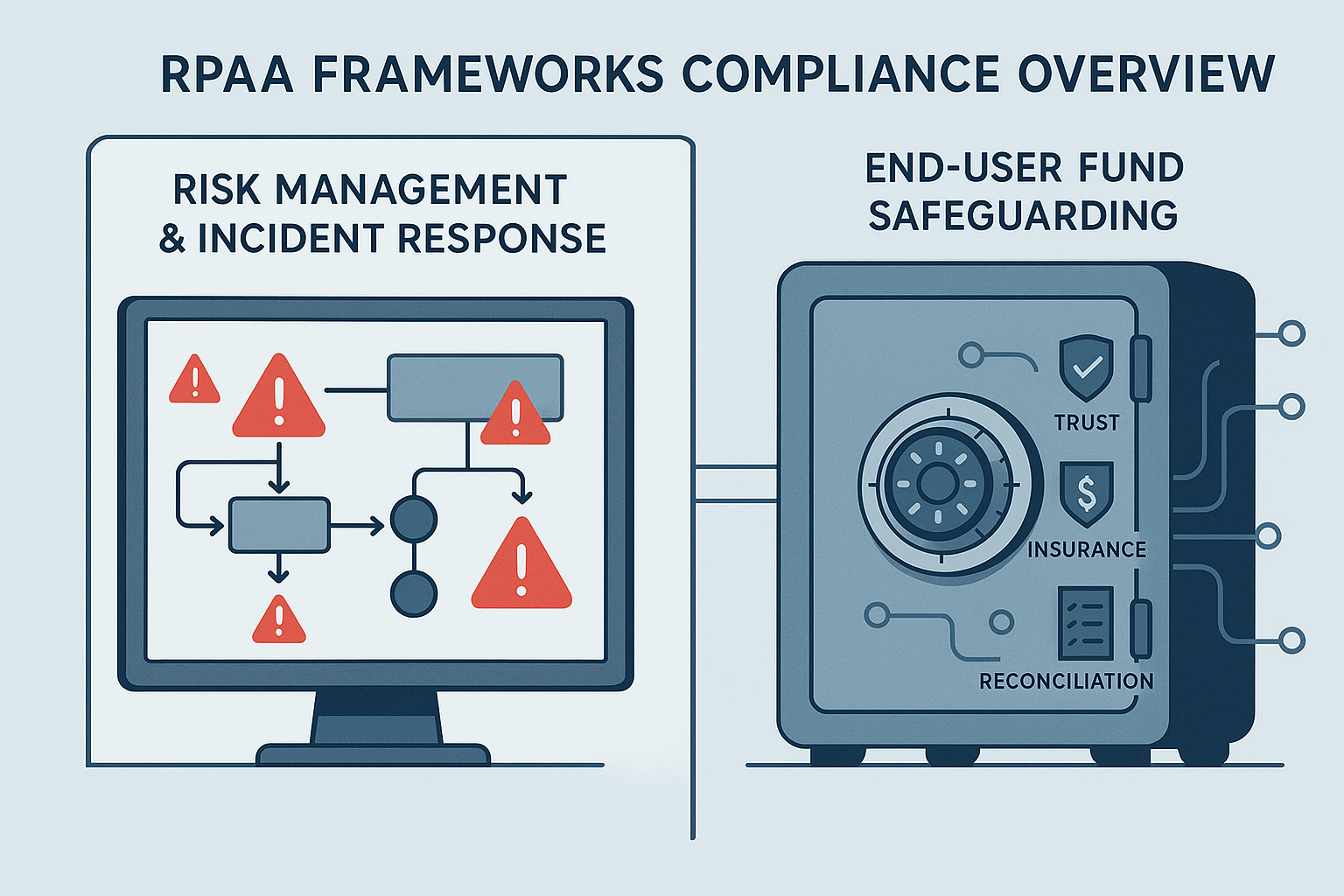

Under the RPAA and the supporting Retail Payment Activities Regulations, two core frameworks must be independently reviewed at least once every three years:

- Risk management and incident response: This framework sets out how a provider identifies, monitors, and responds to operational risks and incidents that could disrupt retail payment activities. The RPAA requires PSPs to demonstrate that these systems are effective and proportionate to their business. Independent testing confirms whether controls really work in practice. See Bank of Canada’s supervisory guideline on operational risk and incident response.

- Safeguarding of end-user funds: If a provider holds customer money, it must have processes to segregate and protect those funds through safeguarding accounts, trust arrangements, or insurance and guarantee mechanisms. An independent review ensures that reconciliations, shortfall coverage, and fund protection methods are operating as required. See Bank of Canada’s guidance on safeguarding end-user funds.

These reviews confirm whether your frameworks are working as intended and whether any adjustments are needed to stay aligned with supervisory expectations.

Who qualifies as an independent reviewer

The RPAA requires that reviews be conducted by someone who is not involved in day-to-day operations of the framework being reviewed. This could be an internal audit team, provided they are separate from operations, or an external consultant.

The Bank of Canada expects reviewers to have “suitable skills” for the task. This generally means a professional with experience in payment systems, compliance, risk management, auditing, or safeguarding practices. They must be able to evaluate controls critically and provide constructive recommendations.

A few qualities of a qualified independent reviewer include:

- Knowledge of the RPAA and Retail Payment Activities Regulations

- Experience with operational risk or safeguarding frameworks in financial services

- Familiarity with incident management and reporting standards

- Ability to conduct testing, review evidence, and identify control gaps

This separation ensures reviews are credible, unbiased, and useful for both the PSP and the regulator.

How to prepare for and benefit from an independent review

Many PSPs worry that an independent review is just another compliance box to tick. But if approached strategically, it can actually deliver lasting business value.

Here are steps to prepare:

- Keep records complete and accessible: Independent reviewers will expect to see evidence such as policies, risk assessments, incident logs, reconciliation records, and board approvals. Under the RPAA, these records must be retained and made available to the Bank of Canada on request. See record keeping guidance.

- Conduct internal self-checks: Run internal audits or mock reviews in advance. This helps identify weaknesses early so they can be fixed before the formal review.

- Engage the board and senior officer: Both governance and safeguarding frameworks require board-level oversight. Make sure directors and the accountable senior officer are briefed and prepared to explain how responsibilities are carried out.

- View recommendations as opportunities: Independent reviews will almost always produce findings. Instead of seeing these as failures, use them to improve resilience, reduce operational risk, and build stronger customer trust.

When handled this way, the three-year independent review becomes more than a regulatory requirement. It becomes a chance to benchmark your controls against best practice and show stakeholders that your payment services are safe and reliable.

Conclusion

Independent reviews under the RPAA are not just red tape. They are a chance to strengthen your risk management and safeguarding frameworks, demonstrate credibility with regulators, and protect your customers. By preparing in advance, selecting qualified reviewers, and treating findings as opportunities, PSPs can turn the three-year review cycle into a competitive advantage.

To explore how compliance support can simplify independent reviews and other RPAA obligations, visit Comply North’s pricing page or reach out to experts through the contact page.