Starting a money services business (MSB) in Canada is exciting, but before you can move a dollar, you need to deal with your first regulatory requirement—FINTRAC MSB registration. This is not an optional step. Whether you are a local company or a foreign business entering the Canadian market, failing to register properly can shut your business down before it even begins. In this guide, we will walk you through who needs to register, how to complete the process, and what to do once you are approved.

Do you need to register?

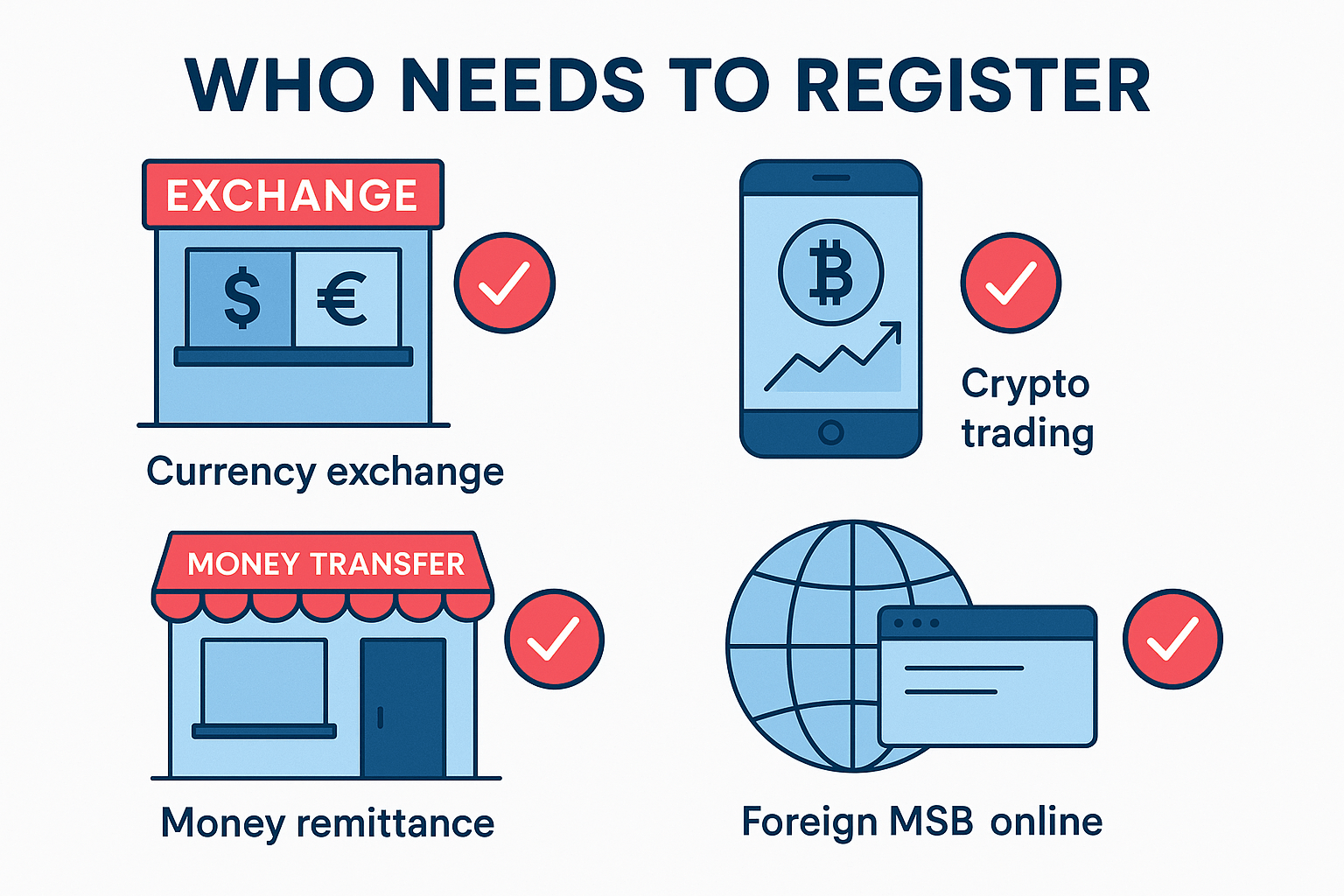

The first step is figuring out if you actually need to register with FINTRAC. Many entrepreneurs ask: Who needs to register as an MSB in Canada? The answer depends on your business model.

You must register if your company conducts any of the following activities:

-

- Money transfers or remittance services

- Currency exchange services

- Dealing in virtual currency (such as crypto trading, custody, or exchange)

Even if you only offer one of these services, FINTRAC requires registration before you begin operations. For example, a small shop offering money transfer services on the side still qualifies as an MSB.

Foreign MSBs are also captured by this rule. Do foreign MSBs need to register in Canada? Yes—if you are outside Canada but offer these services to Canadian customers, you must complete the same FINTRAC registration process as a Canadian MSB.

There are some tricky edge cases worth noting:

-

- Payment processors: If you are strictly processing payments for merchants (like credit card transactions), you may not qualify as an MSB.

- Prepaid products: Selling prepaid cards or gift cards by itself does not make you an MSB, but if you are transferring funds connected to them, you may fall under the rules.

- Non-financial businesses: If money movement is incidental to your main business (for example, a retailer offering refunds or store credit), you are generally not an MSB.

The consequences of operating without registration are serious. FINTRAC can impose penalties, publish your business name on its website, or even refer cases for criminal charges. That is why entrepreneurs searching How do I register as an MSB with FINTRAC need a clear path forward before they launch.

How to register and information you will need

Once you know you qualify, the next step is completing the online process. Think of this as your step by step FINTRAC MSB registration guide.

Here is what to expect:

-

- Create an account on FINTRAC’s registration portal.

- Complete the registration form with required business details.

- Submit the application and wait for FINTRAC to review.

The application is detailed and asks for information about:

-

- Legal and trade names of your business

-

- Ownership and control structure

-

- Directors and senior management

-

- Compliance officer (you must designate one)

-

- Agents and branches, if any

-

- Products and services you will offer

-

- Delivery channels (online, in-person, mobile, etc.)

-

- Geographic areas where you operate

- Expected transaction volumes

FINTRAC expects accuracy and consistency across your application. They may ask you to attest to the truth of your answers, which means you are personally responsible for ensuring the information is correct.

If you are not sure how to answer a question, it is better to seek professional support than risk errors that delay or jeopardize your application. Comply North offers MSB Registration Support at the best price in the industry, with direct connections to FINTRAC. This ensures your application is complete and accurate the first time.

Maintaining and updating your registration

Registration is not a one-time event. Once approved, you must maintain it properly. Many newcomers overlook this stage and risk falling out of compliance.

The FINTRAC MSB registration renewal process requires you to:

-

- Keep all information accurate and up to date

- Report any changes to ownership, directors, products, or contact information within 30 day

- Renew your registration every two years

A common question is: How long does FINTRAC MSB registration take? The initial process varies depending on the complexity of your application, but ongoing compliance is about diligence. You will need to track renewal dates, respond to FINTRAC’s follow-up questions promptly, and make sure your registration matches what your website and marketing claim.

Here are a few practical tips:

-

- Set calendar reminders six months before your renewal date

- Keep a log of business changes so you can update FINTRAC quickly

- Review your website and advertisements regularly to ensure they reflect what you registered

Failing to maintain your registration can trigger penalties just like failing to register in the first place. This is why many MSBs rely on Comply North’s Chief Compliance Officer as a Service. With professional, reliable oversight, you can rest easy knowing your obligations are being handled correctly.

Get support for your MSB registration today

If you are unsure about any part of the process, you are not alone. Many business owners find FINTRAC registration intimidating and time-consuming. Comply North specializes in guiding MSBs through every step—from determining if you need to register, to completing the application, to maintaining compliance over the long term.

Our services are trusted as the best in the industry, backed by professional expertise, and offered at the most competitive rates. Whether you need full MSB Registration Support or a Fractional Compliance Officer, we are ready to help you succeed in Canada’s regulated financial environment.Start today by contacting us directly at Comply North.