When you open an account for a business client, the process is not as simple as asking for a driver’s license. For Money Services Businesses (MSBs) in Canada, Know Your Client (KYC) rules are especially strict when dealing with corporations, partnerships, and trusts. FINTRAC requires MSBs to collect, verify, and maintain detailed records about both the business itself and the people who ultimately control it.

In this blog, we will walk through what information must be collected on corporations, how MSBs identify beneficial ownership in Canada, and what to do if beneficial ownership cannot be confirmed. Along the way, we will show how to build a company ownership chart for MSB compliance and where enhanced due diligence is required.

Collecting Business Information

When an MSB takes on a new corporate client, the first step is collecting business information. FINTRAC requires that you gather the legal name of the corporation or partnership, its registration number, its business address, and the nature of its operations. If the client is a trust, you need to capture the trust deed or formation document that shows how it was set up.

It is not enough to rely solely on what the client tells you. MSBs should check public business registries or request incorporation certificates and partnership agreements. For example, corporations often have a certificate of incorporation or annual filings that list directors and officers. These records help confirm that the information you have matches official registry records.

In short, when asking what information must MSBs collect on corporations, the answer includes:

- Legal name and registration details

- Physical and mailing address

- Nature of the business or activities

- Names of directors for corporations

- Trust deeds or partnership agreements when applicable

The goal is to establish a reliable foundation before moving on to identifying beneficial owners. If your team is unsure how to collect or verify these documents, Comply North offers professional MSB registration support at the best price in the industry.

Beneficial Ownership at 25 Percent

One of the most common questions MSBs ask is: what is the 25 percent beneficial ownership threshold? FINTRAC requires that MSBs identify any individual who owns or controls, directly or indirectly, 25 percent or more of a corporation, partnership, or trust.

This includes both ownership of shares and control through voting rights. For example:

- Direct ownership: An individual holds 30 percent of a corporation’s shares.

- Indirect ownership: An individual owns 60 percent of another company that in turn owns 40 percent of your client’s business.

- Voting control: Someone may only own 10 percent of shares but holds special voting rights that give them control.

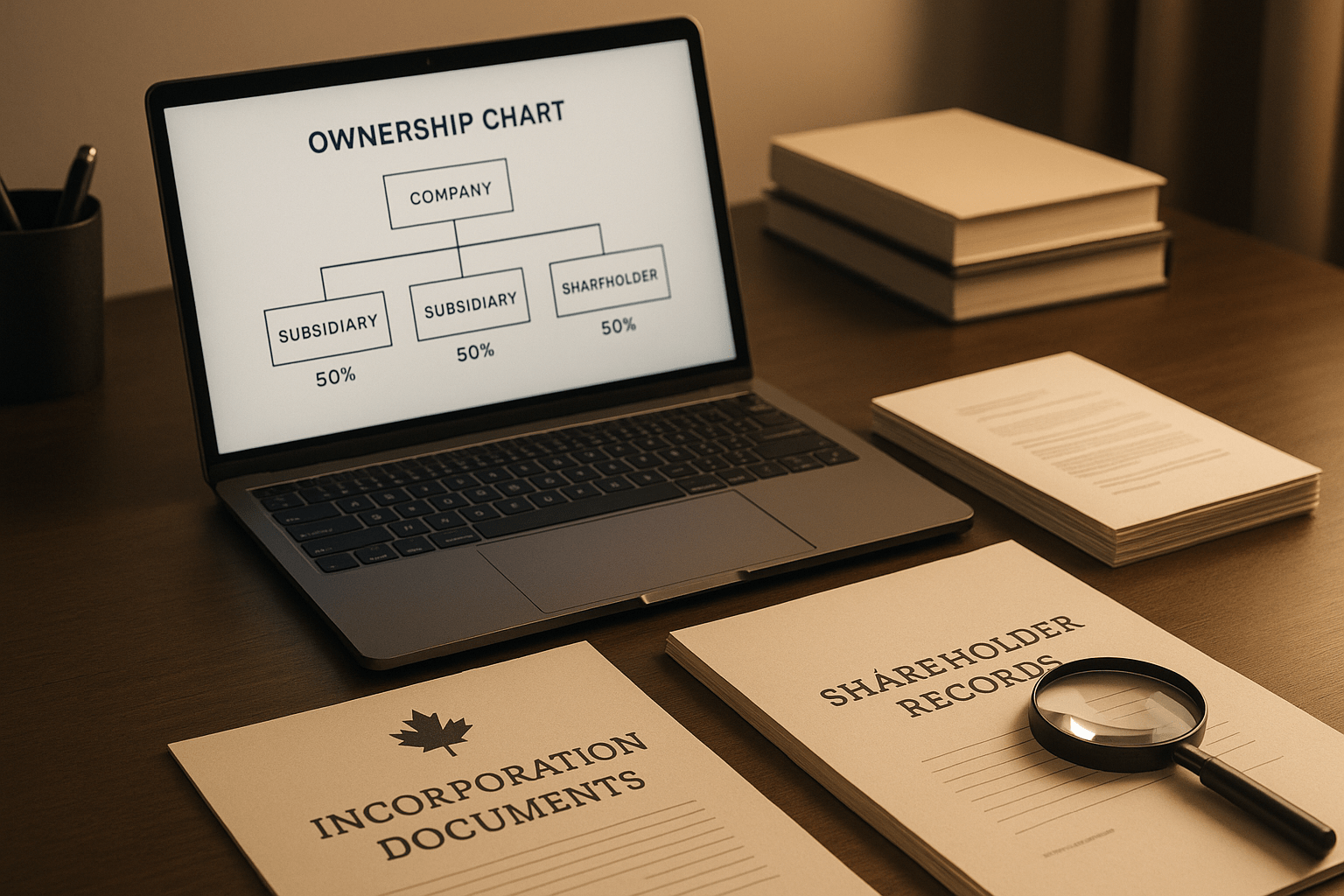

The easiest way to organize this information is to build a company ownership chart for MSB compliance. This chart maps out the corporate structure and shows the names and ownership percentages of each individual with control. MSBs must record these details and keep them updated.

How do MSBs identify beneficial ownership in Canada? By using formation documents, shareholder registers, and ownership attestations provided by the business. When in doubt, additional supporting documents should be requested.

Verifying Directors and Control When Ownership is Unknown

Sometimes, despite your best efforts, you cannot confirm the ultimate beneficial owner. What to do if beneficial ownership cannot be confirmed? FINTRAC’s guidance is clear: MSBs must take reasonable measures, and if ownership cannot be established, you must verify the identity of the senior managing officer instead.

Reasonable measures may include:

- Asking the business for shareholder or trust agreements

- Requesting corporate resolutions

- Reviewing registry searches across multiple jurisdictions

If all of these fail, MSBs should shift their focus to the person with the highest authority in the organization. How can MSBs verify a senior managing officer? The same way they would verify any individual client—through government-issued photo ID or other acceptable KYC methods.

In these cases, MSBs must apply enhanced measures, such as closer transaction monitoring or more frequent reviews. FINTRAC outlines these expectations in its compliance guidance, which you can review here.

Keeping records is just as important as collecting them. What records of ownership must MSBs keep? All supporting documents, ownership charts, shareholder registers, and notes on attempts to verify beneficial ownership must be stored for at least five years. This ensures that if FINTRAC reviews your business, you can demonstrate your compliance efforts.

If this sounds overwhelming, remember that Comply North provides Chief Compliance Officer as a Service. Our fractional compliance officers are professional, reliable, and directly connected with FINTRAC. We make sure your MSB always stays ahead of regulatory requirements.

Final Thoughts

KYC for corporations, partnerships, and trusts is a lot more involved than identifying individual clients. MSBs must collect core business information, determine beneficial ownership at the 25 percent threshold, and apply enhanced due diligence when ownership cannot be confirmed.

By building clear ownership charts, verifying directors, and documenting every step, MSBs can protect themselves from regulatory penalties and maintain a solid compliance record.

If your MSB needs guidance with beneficial ownership requirements, reach out to Comply North. Whether it is registration support or a fractional Chief Compliance Officer, we provide the best compliance expertise in the industry. Contact us today to learn more.