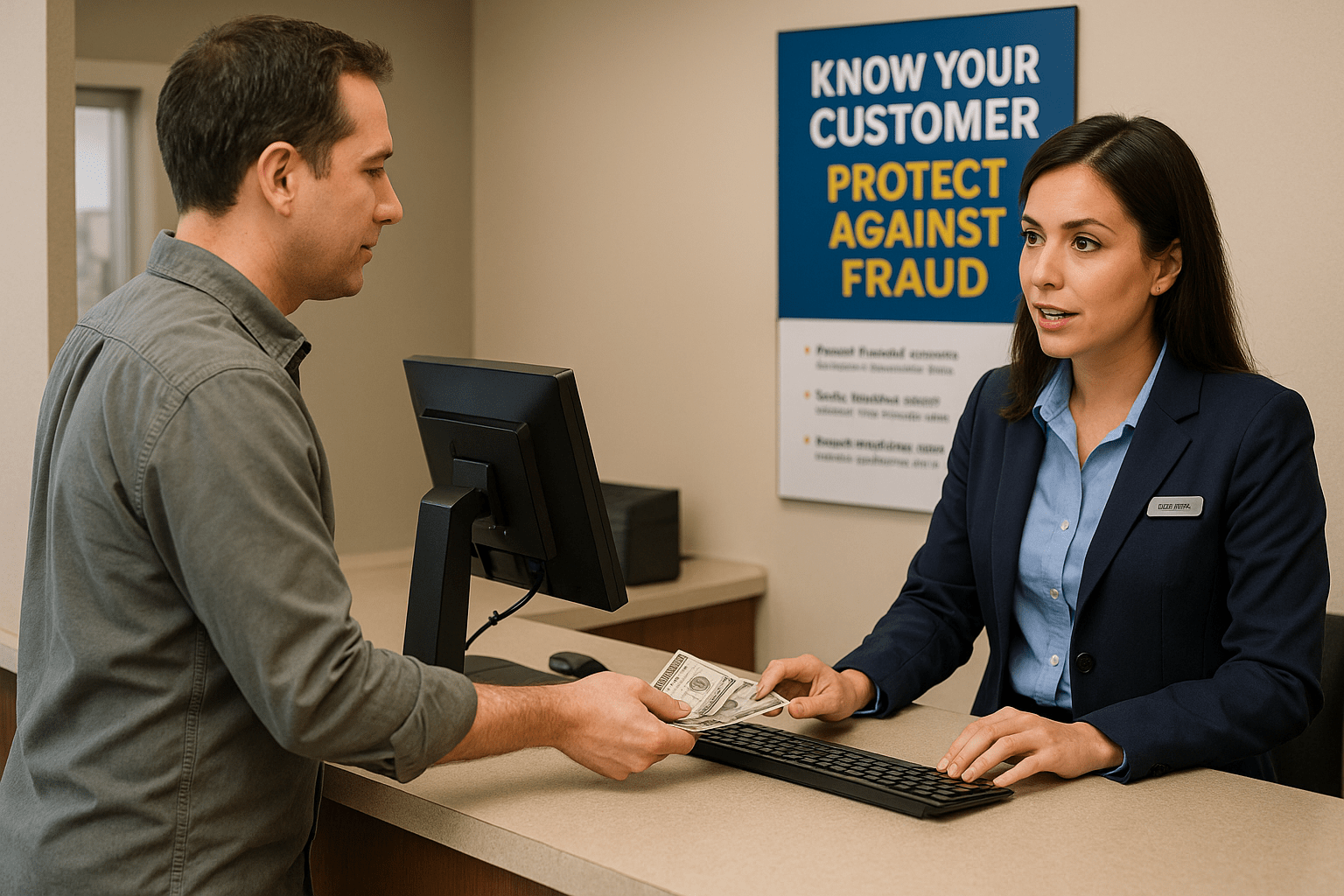

When you run a Money Services Business (MSB) in Canada, you are not only moving money for clients—you are also on the frontlines of detecting financial crime. One of the most important compliance steps you must understand is third party determination. FINTRAC requires all MSBs to check if a client is acting for someone else. This process helps reduce the risk of money laundering and terrorist financing and keeps your business in good standing with regulators.

Let’s break down what third party determination means, what information you must collect, and the red flags you should watch for when serving your clients.

When a client is acting for someone else

So, what is a third party determination for MSBs? In plain terms, it’s the process of checking if the person using your services is doing so on behalf of another individual or organization. This often happens when an agent, nominee, or even a family member carries out a transaction for someone else. While this can seem harmless, it creates extra risks because the real purpose and source of funds can be hidden.

For example, a son may deposit funds on behalf of his father, or a business manager may transfer money on behalf of a company owner. On the surface these may seem like routine situations, but they could also be used by criminals to hide their true identity. This is why FINTRAC requires MSBs to ask and record who the client is really acting for.

By making this check every time it applies, you protect your MSB, your reputation, and contribute to Canada’s broader fight against financial crime. FINTRAC’s detailed guidance explains these responsibilities clearly here.

What to collect and document

When must MSBs collect third party information? The answer is whenever you have reasonable grounds to believe that a client is acting for another person. At this point, you are required to collect and record specific details about that third party.

What information must be recorded about third parties? FINTRAC lists the following as mandatory:

- The full name of the third party

- Their address

- Their date of birth, if applicable

- The nature of the relationship between the client and the third party

This information can be gathered through onboarding forms, transaction records, or through direct questioning when a transaction takes place. For example, if a client explains that they are sending money for their employer, you must record not only the client’s details but also the employer’s details as the third party.

It’s important to document this information in a way that can be retrieved quickly for compliance reviews or FINTRAC audits. Many MSBs build dedicated third party sections into their client forms so staff don’t forget to ask. If you’re unsure about how to structure these records, Comply North can provide professional templates and advice to keep your processes efficient and audit-ready.

Red flags and controls

How to identify if a client is acting for another person is not always straightforward. Many clients will not volunteer the information unless you ask directly. That’s why MSBs must be alert to red flags for hidden third parties in MSB transactions. Common warning signs include:

- Inconsistent explanations from the client about who the funds are for

- Unexplained or unusual sources of funds

- A client who avoids providing details or resists answering questions

- A transaction that doesn’t match the client’s profile or history

When you notice these indicators, you may need to apply enhanced due diligence. This could mean asking more questions, verifying the source of funds, or escalating the file to your Chief Compliance Officer. If you suspect the activity involves money laundering or terrorist financing, you must consider filing a Suspicious Transaction Report (STR) with FINTRAC. Guidance on STRs can be found directly here.

How to complete a third party record for FINTRAC requires attention to detail. Records should be accurate, complete, and stored properly. When third party information is unclear or incomplete, you cannot simply ignore it. Instead, document the attempts made to collect the data, escalate the concern, and decide whether the transaction should proceed.

This is where having expert support can save you time and stress. Comply North offers Chief Compliance Officer as a Service—a fractional compliance officer who can guide you through tough decisions and help you manage FINTRAC reporting obligations with confidence.

Taking third party checks seriously

Third party determination is not just a box to check. It is a key safeguard that helps protect your MSB from being exploited. By asking the right questions, collecting the right details, and watching for red flags, you strengthen your compliance program and demonstrate to FINTRAC that you take your obligations seriously.

If you need support building stronger processes, Comply North can help. From MSB registration support to ongoing compliance services, we provide professional, reliable, and cost-effective solutions that connect directly with FINTRAC requirements. Learn more about our services here or reach out to us here to get started today.