When people think of business continuity and disaster recovery, they often picture large banks with complex infrastructure. But under the Retail Payment Activities Act (RPAA), these requirements apply to all payment service providers (PSPs), regardless of size. Whether you are a global fintech or a small money services business, you must have a plan to keep payment services running during disruptions and recover quickly when things go wrong.

The Bank of Canada has made it clear that continuity planning is not optional. It is a core supervisory expectation designed to protect end users, maintain trust, and safeguard the stability of the entire payments system.

For reference, see the Operational risk and incident response guidance, the step-by-step incident response guide, and the business continuity expectations under the RPAA.

Why continuity planning is required for all PSPs

The RPAA and Retail Payment Activities Regulations (RPAR) make it clear that every PSP must embed resilience into its operations. A disruption in retail payments can have real consequences: wages might not get paid, bills could go unpaid, and end users may lose access to their funds. That is why the law requires PSPs to prepare for a wide range of disruptions, from cyber attacks and system outages to natural disasters and third-party failures.

The Bank of Canada expects PSPs to conduct a business impact analysis (BIA) to identify their most critical services and dependencies. This is not just a paperwork exercise. It is a way to understand which processes must keep running no matter what, and how long you can afford to have others offline before customers and the wider payments system are harmed.

Recovery time objectives, data availability, and testing expectations

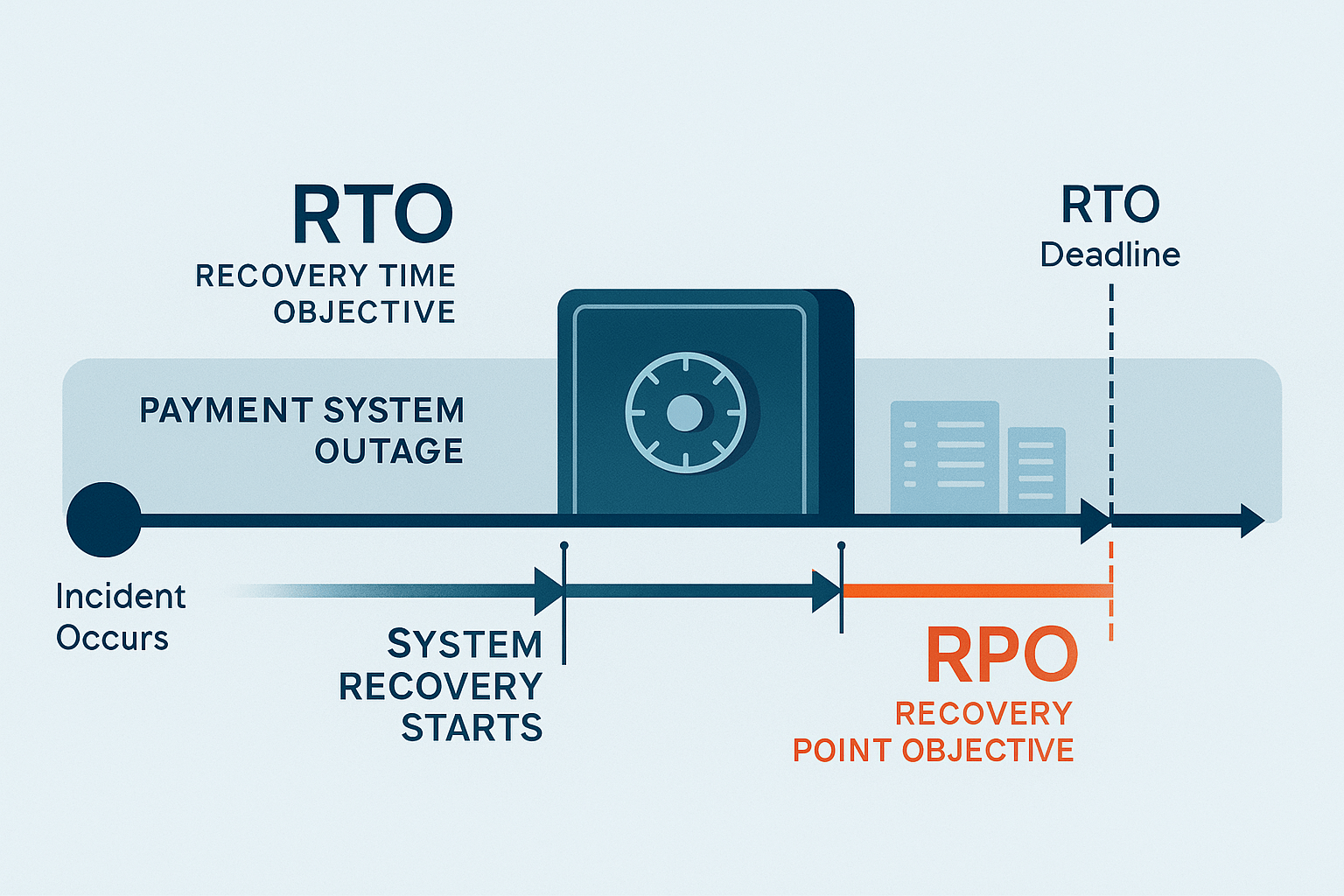

A compliant business continuity and disaster recovery (BCDR) framework must establish clear recovery objectives. Two key measures are required:

- Recovery Time Objective (RTO): The maximum amount of time a service or system can be down before it must be restored. For example, a payment processing platform might have a 24-hour RTO.

- Recovery Point Objective (RPO): The maximum amount of data the PSP can lose during a disruption. For instance, if the RPO is four hours, then backups must ensure that no more than four hours of transaction data is lost.

These objectives are not theoretical. The RPAA requires PSPs to test their continuity and recovery plans regularly to ensure they are realistic and achievable. Testing can include tabletop exercises, live failover tests, or simulations of cyber incidents. Records of all tests and results must be kept for at least five years and be available to the Bank of Canada on request.

Testing also ensures staff know their roles during disruptions, from activating backups to notifying regulators through PSP Connect within the required 48-hour window when a material incident occurs (Bank of Canada Incident Notification).

Integrating incident response and continuity planning

One of the most practical ways to meet RPAA obligations is to integrate incident response and continuity planning into one cohesive framework. The Bank of Canada’s guidance on operational risk emphasizes that incident response and business continuity are interconnected.

When an incident occurs, such as a system crash or cyber attack, your incident response plan ensures immediate containment and regulatory notification. From there, your continuity plan takes over to restore services and data availability. Together, these frameworks protect the integrity, confidentiality, and availability of payment services.

An integrated approach ensures:

- Faster decision-making during crises

- Clear roles and responsibilities across compliance, IT, and operations

- Better coordination with third-party providers and agents

- Evidence that regulatory obligations are being met in real time

The RPAA also requires that both incident response and continuity planning be proportionate to your size and risk profile. A smaller PSP may not need the same complexity as a major bank, but it must still show that its plans are robust, tested, and documented.

Why this matters for PSPs

Continuity and disaster recovery planning under the RPAA is not just about ticking a regulatory box. It is about protecting customers, preserving your reputation, and ensuring long-term stability. Disruptions are inevitable, but with tested and integrated plans, PSPs can minimize harm and recover quickly.

By investing in strong continuity and recovery frameworks, PSPs also position themselves as reliable partners in a competitive payments market where trust is everything.

Final thoughts

Every PSP must comply with the RPAA’s continuity and disaster recovery requirements, no matter their size. This means conducting impact analyses, setting recovery objectives, testing plans, and integrating incident response with continuity strategies. Doing so not only satisfies regulators but also builds resilience and trust in your services.If your business is ready to strengthen its continuity framework, explore Comply North’s pricing page to see how compliance tools can give you an advantage, or contact our experts for tailored support.