For Money Services Businesses (MSBs) in Canada, knowing your customer (KYC) is not just good practice—it is the law. FINTRAC requires MSBs to verify customer identities in specific situations, keep clear records, and apply consistent methods. Many business owners feel overwhelmed by the details, but understanding the basics of KYC for individuals can make compliance much simpler. This guide breaks down when to verify identity, how to do it, and what records you must keep.

When to verify identity

The first question many new operators ask is: when do MSBs need to verify customer identity? FINTRAC sets clear rules. Identity must be verified in key trigger situations such as:

- When opening an account for a client

- Before conducting certain large transactions, including those over $10,000

- When processing international electronic funds transfers

- If there is suspicious activity that triggers a suspicious transaction report

- At specific thresholds where rules require client information

Timing matters. In most cases, you must verify the identity before completing the transaction. Some rules allow a short grace period, but it is safest to assume verification comes first. If you delay, you risk being non-compliant and facing penalties.

For new MSBs, these rules can feel like obstacles to growth. But with clear processes in place, verifying identity becomes a natural step in your operations. If you need help setting these processes, Comply North offers MSB registration support and ongoing compliance guidance to make sure you never miss a requirement.

How to verify identity methods

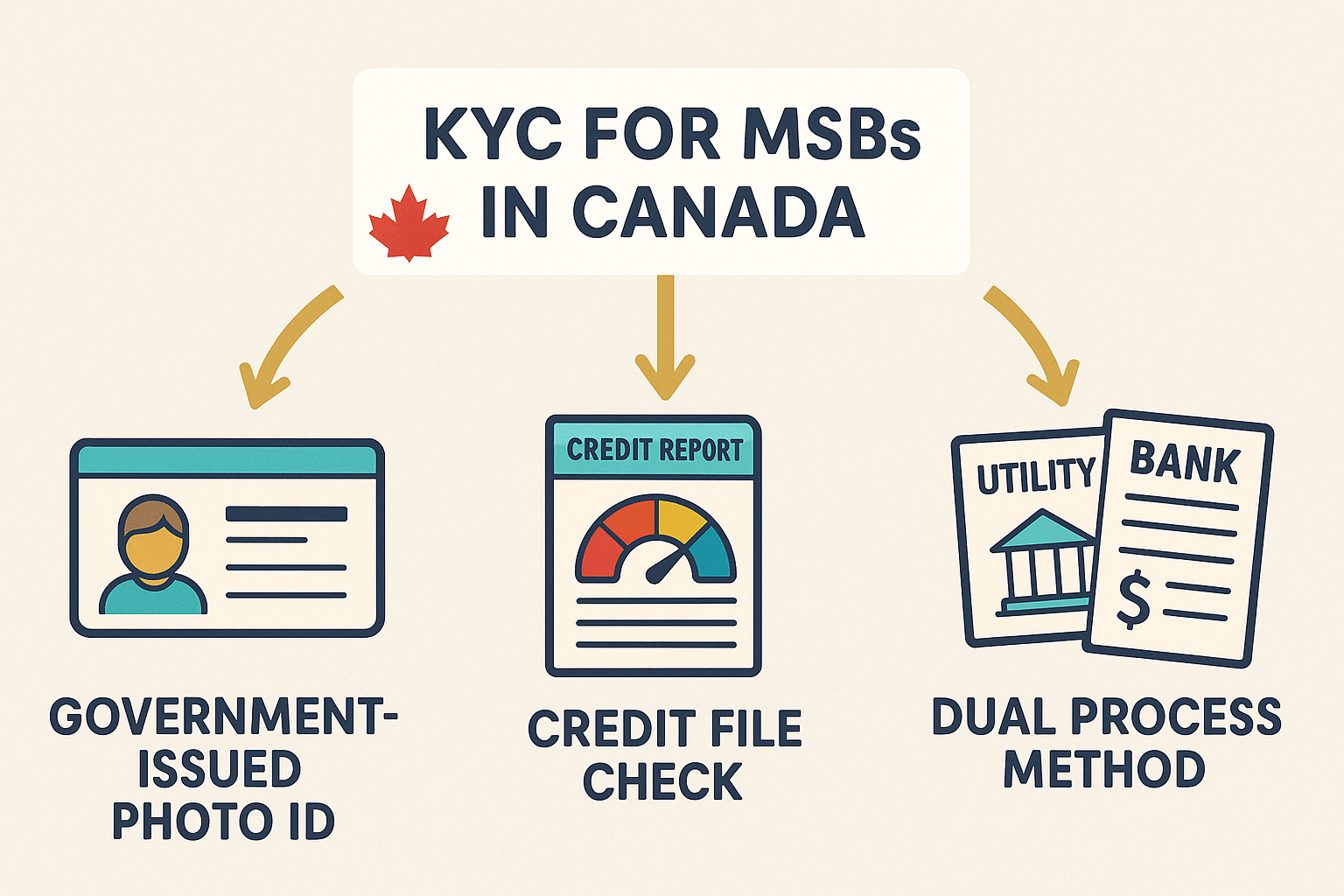

Once you know when to verify, the next question is what methods can MSBs use for identity verification? FINTRAC allows several approaches, and you can choose the one that works best for your client interactions.

The most common methods include:

- Government-issued photo ID: A valid driver’s license, passport, or provincial card is acceptable. Can MSBs use photo ID for KYC verification? Yes—this remains the most straightforward method, provided the document is original and valid.

- Credit file method: What is the credit file method for FINTRAC KYC? This means checking the client’s name, address, and date of birth against a Canadian credit bureau file that has been active for at least three years.

- Dual process method: This involves using two reliable sources, such as utility bills or bank statements, to confirm name and address or name and date of birth.

- Reliable technology solutions: Increasingly, MSBs use remote onboarding tools. Tips include liveness detection, where the client’s selfie is compared to their ID photo, and systems that flag potential fraud.

No matter which method you choose, the key is authenticity. You must make reasonable efforts to ensure the information is valid. If something looks suspicious, do not proceed until the doubt is resolved.

For MSBs with growing customer bases, outsourcing part of this function can save time and reduce risk. Comply North provides a fractional Chief Compliance Officer service, giving you access to industry experts who can help you set up the best verification methods at the best price in the industry.

Record keeping and exceptions

After verification, your job is not done. You must also maintain proper records. How long must MSBs keep client identification records? FINTRAC requires MSBs to keep these records for at least five years from the date of the last transaction. That means even if the client leaves, their records must be stored securely for the retention period.

A proper record includes:

- The client’s full name, address, and date of birth

- Details of the method used to verify their identity

- Copies or references of the documents reviewed

- The date verification took place

But what happens if an MSB cannot verify identity? In those cases, you may not be able to proceed with the transaction. You should note the attempt, record the reason for failure, and consider whether a suspicious transaction report is required. It is better to refuse service than to risk non-compliance.

Exceptions are rare and must always be documented. For example, if a client cannot provide standard identification due to unusual circumstances, you must record the reason and keep evidence of alternative steps taken.

Compliance is not only about following the rules; it is about protecting your business from financial crime and reputational harm. That is why Comply North partners with MSBs to set up strong compliance programs that keep you aligned with FINTRAC while allowing you to focus on business growth.

Final thoughts

KYC for individuals may sound complicated, but once you understand the triggers, methods, and recordkeeping requirements, it becomes a repeatable process. Knowing when to verify identity, how to verify ID for an MSB transaction in Canada, and what to do when verification fails gives you confidence and keeps your business safe.

If you are just starting out or need to upgrade your compliance program, Comply North can help. With direct connections to FINTRAC, professional guidance, and the best compliance services in the industry, we make it easy for MSBs to stay on the right side of the law.

For further details on KYC rules, visit FINTRAC’s official guidance on verifying identity and compliance program requirements.