Staff training is a cornerstone of compliance under the Retail Payment Activities Act (RPAA). The law requires payment service providers (PSPs) and money services businesses (MSBs) to show that their employees and contractors understand their responsibilities, can apply controls in practice, and remain competent over time. Without evidence of training, even the strongest policies will not satisfy regulators like the Bank of Canada.

This article explains who needs RPAA training, how often it should be provided, and the best practices for documenting training to demonstrate compliance.

Who Needs RPAA Staff Training

Under the RPAA, all employees, contractors, and agents involved in payment activities must receive training that matches their role and responsibilities. This includes frontline staff processing transactions, IT teams supporting payment platforms, compliance staff monitoring risks, and senior officers overseeing governance. According to the Governance and Oversight framework, competence and training are essential to demonstrating accountability across the organization.

Contractors and third parties are also in scope when they provide services critical to payment activities. For example, outsourced IT providers, cloud vendors, and agents handling transactions must be trained on controls that affect their work. The Bank of Canada’s operational risk and incident response guidance makes it clear that accountability for compliance remains with the PSP, even if third parties are involved (Operational Risk and Incident Response, Bank of Canada).

In short, if someone touches systems, data, or processes related to retail payment activities, they must be trained.

How Often Training Must Be Completed

Training is not a one-time event. The RPAA requires ongoing competence that matches the evolving risks of payment services. At a minimum, training should occur:

- Onboarding: Every new employee or contractor should receive RPAA onboarding training before they begin handling payment activities.

- Annually: A full refresher course should be completed each year to confirm understanding and update staff on new risks or regulatory changes.

- When material changes occur: If the company launches a new product, adopts a new technology, or makes a significant process change, training must be updated immediately. The Bank of Canada requires notification of significant changes, and staff training is a critical part of that process (Notice of Significant Change, Bank of Canada).

The Business Continuity and Disaster Recovery framework highlights the importance of training before, during, and after incidents to ensure staff can apply recovery procedures effectively.

In practice, this means every staff member has a clear training schedule that covers onboarding, annual refreshers, and ad-hoc sessions triggered by material changes.

Documenting Training and Demonstrating Competence

Regulators will not take your word for it that staff are trained. They expect evidence. According to the RPAA record-keeping requirements, PSPs must maintain accurate and accessible records of all training completed.

The following best practices will help demonstrate compliance:

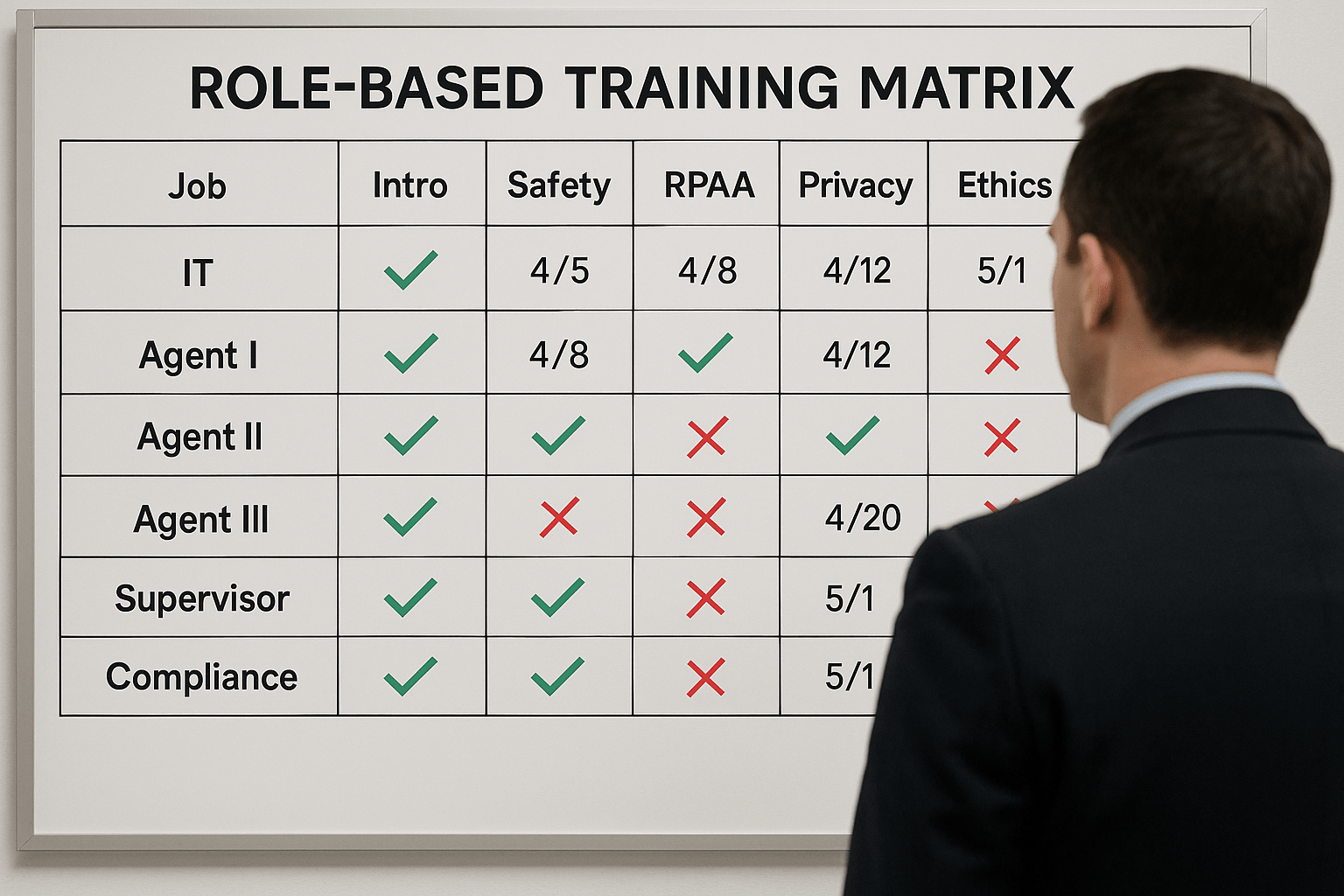

- Maintain a training matrix: Map out which roles require which training modules, and ensure completion is tracked.

- Keep signed records: Have employees sign acknowledgements or digital confirmations once training is complete.

- Test understanding: Use short quizzes, simulations, or scenario-based exercises to confirm that staff can apply knowledge in practice.

- Link training to incidents: After an incident or near miss, provide targeted retraining and document the corrective action. The Bank of Canada’s incident notification framework (Incident Notification, Bank of Canada) emphasizes the importance of lessons learned and competence testing.

- Store records for at least 5 years: Training logs, tests, and acknowledgments should be easily retrievable for supervisory review, in line with RPAA record-keeping obligations.

This evidence ensures that when regulators ask how your organization meets RPAA training requirements, you can provide clear documentation.

Why Training Matters for Compliance and Trust

Training is more than a checkbox for regulators. It builds competence across the organization, reduces the likelihood of errors, and strengthens customer trust. Safeguarding obligations, for example, rely heavily on staff understanding how to properly segregate funds and reconcile accounts. Similarly, effective incident management depends on employees knowing how to escalate issues quickly and follow response protocols.

When staff are well-trained, companies can demonstrate resilience, comply with the RPAA, and protect the integrity of Canada’s payment ecosystem.

Conclusion

RPAA training requirements are not optional or generic. They are specific, role-based, and recurring. Employees, contractors, and agents must be trained at onboarding, annually, and whenever material changes occur. Training records must be kept as evidence, with clear documentation of competence.

By embedding RPAA compliance training into daily operations, PSPs and MSBs not only meet legal obligations but also build stronger, safer businesses.

To learn how to simplify compliance with structured RPAA training and record-keeping, visit Comply North’s pricing page for cost-effective solutions or reach out directly through the contact page to connect with experts.